north dakota sales tax registration

You can get information about what you should do and what you need to do. Step 1 Begin by downloading the North Dakota Certificate of Resale Form SFN 21950.

We recommend submitting the application via the online website as it will generally be processed faster and you will receive a confirmation upon submission.

. Register for a North Dakota salesuse tax number. While some North_Dakota businesses may need a local business license or a business permit some North_Dakota businesses may also need to follow federal. Business entities that sell tangible goods or offer services may need to register for sales and use taxes at the state level.

A business must register for a sales and use tax permit in North Dakota when. There are two ways to register for a sales tax permit in North Dakota either by paper application or via the online website. In addition purchases for environmental upgrades that exceed.

RegisterChange a Permit Register or Change a Sales Tax Permit. Once you complete the online. Remote sellers who only met the transactions threshold in 2018 or 2019 must continue to collect North Dakota sales tax through June 30 2019.

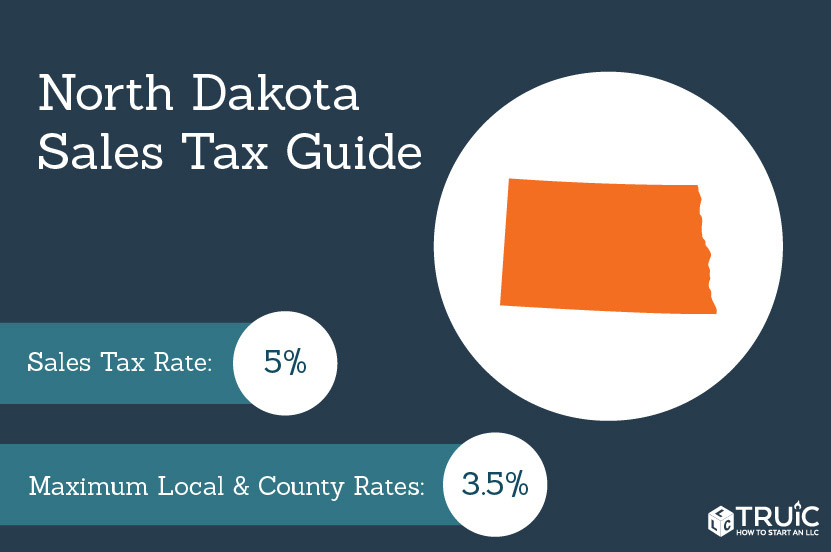

North dakota sales tax registration Tuesday May 17 2022 Edit. Registered users will be able to file and remit their sales taxes using a web-based PC program. Currently combined sales tax rates in North Dakota range from 5 to 8.

Tax ID Bureau eServices stays current with the changing laws forms and documents in order to ensure a smooth quick and efficient sales tax registration for your business. Gross receipts tax is applied to sales of. Thank you for selecting the State of North Dakota as the home for your new business.

State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. North Dakota state county city municipal tax rate table. North Dakota Tax Table.

North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. Before applying for a North Dakota. A business has sales tax nexus also referred to as economic nexus.

This is a sales and use tax exemption for building materials equipment and other tangible personal property used to expand or construct an oil refinery in North Dakota. Application to Register for a Sales Tax Certificate of Authority Form DTF-17 Use this form for registering to collect sales tax. Boulevard Ave Dept 127.

How much is the car sales tax rate in North Dakota. 20 feet and longer. How do you register for a sales tax permit in North.

Step 3 Identify what the purchasers business sells leases or rents. This is the only form used in North Dakota to report sales tax. This blog gives instructions on how to file and pay sales tax in North Dakota using form ST.

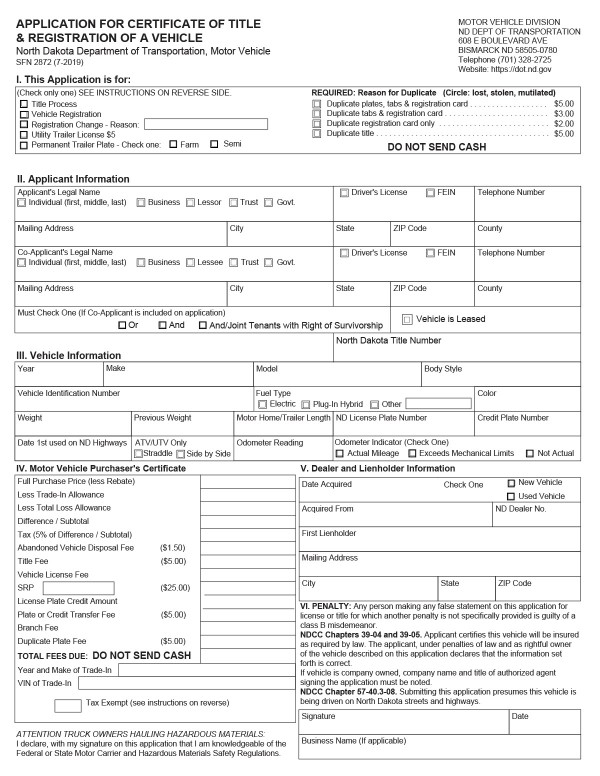

A North Dakota vehicle registration is documentation that connects residents of the North Dakota with the transportation they own such as a passenger vehicle motorcycle or boat. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view payments edit contact information and more. North Dakota first adopted a general state sales tax in 1935 and since that time the rate has risen to 5.

Office of State Tax Commissioner. Most states require businesses to either incorporate or foreign qualify prior to registering for a sales and use tax account and many states also ask for the IRS. North Dakota sales tax is comprised of 2 parts.

North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax Commissioner. This includes business planning. Step 2 Enter the purchasers State of origin and State and Use Tax Permit number.

Licensing requirements for North Dakota businesses. Instructions For Form DTF-17. The sales tax is paid by the purchaser and collected by the seller.

North Dakota sales tax. Nexus means having a physical presence in the. If you hold a North Dakota sales and use tax permit you may file your sales and use tax returns over the.

Step 4 Include the name of the seller. Registrations are valid from January 1 2020 to December 31 2022 fees are prorated according to the date of. New farm machinery used exclusively for agriculture production at 3.

North Dakota individual income taxpayers you can also utilize TAP to make electronic payments check the status of your refund search for a. The facility must have a nameplate capacity of processing at least 5000 barrels of oil per day. Here youll find information about taxes in North Dakota be able to learn more about your individual or business tax obligations and explore history and data related to taxes.

Having a submission confirmation will help in the event that. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 35. The topics addressed within this site will assist you in planning and establishing your business.

When you select the form Preparation Service package below all the license permit tax registration applications required for your specific type and place of business will be filled out. The cost of a North Dakota Sales Tax Permit depends on a companys industry geographic service regions and possibly other factors. Register online for a North Dakota Sales Tax Permit by completing the simple and secure online form questionnaire in just a few minutes.

Step 5 Enter the purchasers business name and. Manage your North Dakota business tax accounts with Taxpayer Access point TAP. After June 30 2019 those remote sellers may cancel their North Dakota sales and use tax permit and discontinue collecting North Dakota sales tax.

Send the completed form to. Although North Dakotas regular sales tax can range from 475 up to 85 if youre buying a car a flat 5 sales tax is always applied. Quarterly sales use and gross receipts tax return and.

800 524-1620 Sales Tax Application Organization. 5 of the sale price. Or file by mail using the North Dakota Application for Income Tax Withholding and Sales and Use Tax Permit.

Making retail sales andor taxable services in North Dakota includes occasionally selling items at. The statewide sales tax in North Dakota is 5 and that rate applies to any vehicle purchased anywhere in the state. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases.

Welcome To The New Business Registration Web Site.

Incorporate In North Dakota Do Business The Right Way

How To Start A Business In South Dakota A How To Start An Llc Small Business Guide

Sales Tax Guide For Online Courses

North Dakota Secretary Of State Nd Sos Business Search Secretary Of State Corporation Search

How To Register For A Sales Tax Permit Taxjar

North Dakota Charitable Registration Harbor Compliance

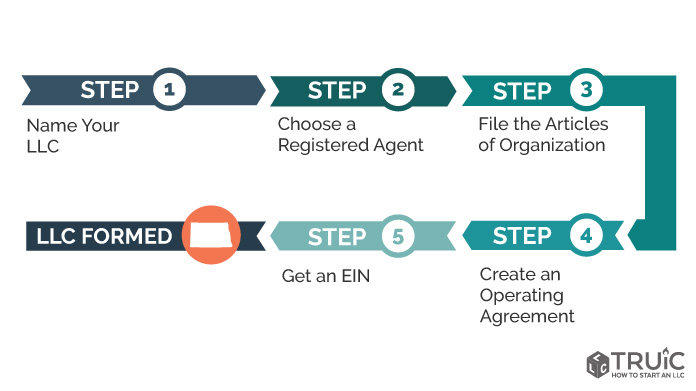

North Dakota Llc How To Start An Llc In North Dakota Truic

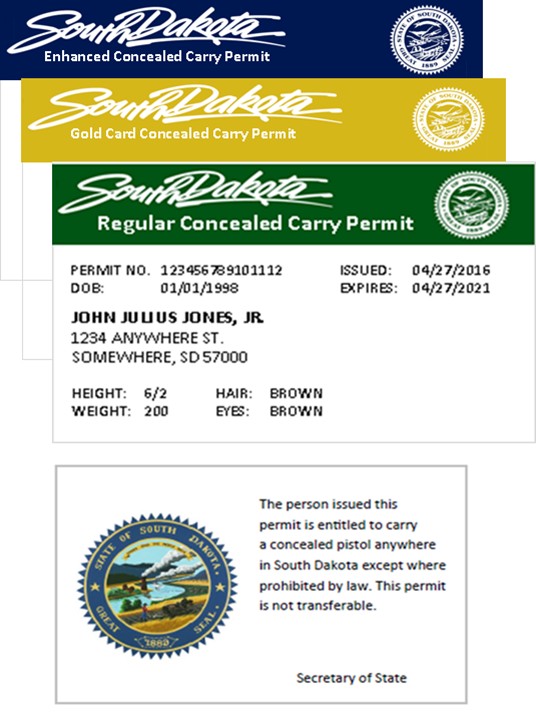

Concealed Pistol Permits South Dakota Secretary Of State

How To Register For A Sales Tax Permit In North Dakota Taxjar

Instructions On Obtaining A Resale Certificate Sales Tax License

About Bills Of Sale In North Dakota What You Need To Know

How To Register For A Sales Tax Permit In North Dakota Taxjar

North Dakota Tax Refund Fill Online Printable Fillable Blank Pdffiller

Instructions On Obtaining A Resale Certificate Sales Tax License

Instructions On Obtaining A Resale Certificate Sales Tax License